EU Digital Operational Resilience Act (DORA)

The EU Digital Operational Resilience Act (DORA) establishes a unified regulatory framework to strengthen digital risk management in the financial services sector. DORA ensures that financial institutions and their third-party IT providers can withstand, respond to, and recover from cyber and operational disruptions.

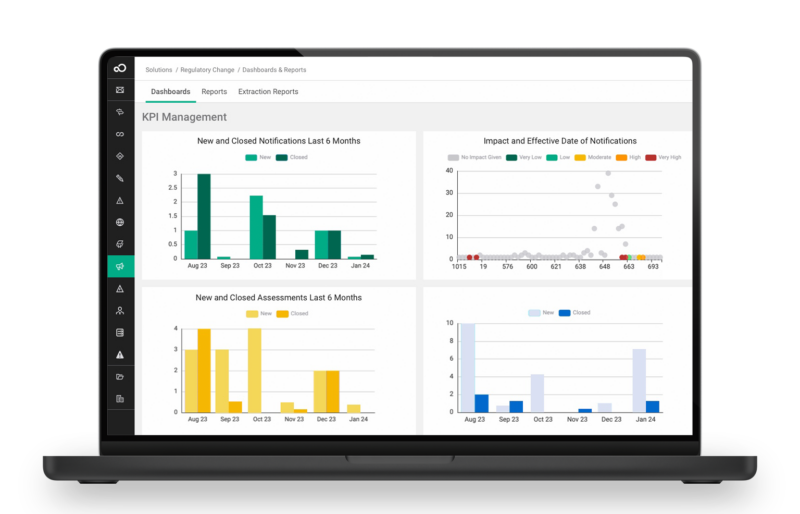

SAI360 delivers a comprehensive digital operational resilience solution that directly maps to DORA’s five pillars. Our software platform empowers financial entities to proactively manage IT risks, streamline incident response, validate resilience through testing, and ensure governance over third-party providers.

With built-in regulatory compliance capabilities and full integration across risk, continuity, and audit functions, SAI360 helps your organization meet DORA requirements while building long-term digital resilience.

Modules That Power The Solution

FAQs

Let Us Help

SAI360 gives you the tools to stay resilient and DORA-compliant with an integrated solution to: